The City of London, the world’s most central financial hub and site of the biggest Eurodollar money market which LIBOR was created to govern.

The importance of uncovering the complete truth about the LIBOR rigging conspiracy cannot be overstated for local communities across the United States, especially here in California.

It’s been five years since a few academics and journalists began to dig up evidence that something was wrong with the London Inter-Bank Offered Rate, or LIBOR (pronounced appropriately as “lie-bore.”) The data that curious researchers were compiling couldn’t be explained using the prevailing definition of what LIBOR supposedly was: a trustworthy interest rate that accurately gauged the market price of borrowed US dollars held overseas by the world’s biggest banks. Instead, their findings pointed toward something other than an idealized neoliberal market, influenced only by impersonal supply and demand forces. Many began to realize that the data could easily be explained if the banks were rigging the LIBOR rate in their favor. Strange discrepancies in LIBOR’s correlation to other rates, and to the economic fundamentals of the bank companies responsible for formulating the rate, showed something seriously amiss, but it made sense if the banks were cheating.

The motives of the banks have been clear from the beginning. A few banks that dominate the marketplace for derivatives stand to make billions if LIBOR moves in their favor on particular days when contractual payments between them and their customers come due. They therefore suppressed the rates in order to skim billions of dollars off derivatives and investments. Later these same banks suppressed LIBOR rates to create the illusion that their balance sheets were robust during the financial crisis. This also allowed them further rounds of money-siphoning from their unwitting derivatives customers.

Until recently LIBOR rates have been set by a panel of banks that are members of the British Bankers Association (BBA). The BBA is a private industry group established almost 100 years ago to lobby for the financial industry in one of its global hubs, London. The BBA really came into power in the mid-1980s with the creation of LIBOR. LIBOR was created to further integrate the giant global money market in US dollars held in overseas banks or holding companies, and therefore unregulated by the US Federal Reserve. Called “Eurodollars,” because they originally were dollar savings accumulated in European banks, especially banks in London, these funds quickly became a de facto global currency. LIBOR began as a way for the banks to standardize investment products for these vast pools of American dollars flowing through Europe, and later Japan, the Middle East, and Latin America. By the 1990s LIBOR had become such an important set of interest rates, and US dollars held overseas had becomes such an important source of credit for US consumers, that LIBOR became the key global interest rate around which many financial products were pegged. As LIBOR became more and more important to the globalization of finance, it accrued a sort of official, trusty gloss; nearly everyone assumed that LIBOR was a market rate reflecting competition. Instead, LIBOR has probably all along been a fudged rate, determined less by vast market forces and invisible hands, and more by the vulgar self-interest and power of the elite banks that set LIBOR rates.

Until recently LIBOR rates have been set by a panel of banks that are members of the British Bankers Association (BBA). The BBA is a private industry group established almost 100 years ago to lobby for the financial industry in one of its global hubs, London. The BBA really came into power in the mid-1980s with the creation of LIBOR. LIBOR was created to further integrate the giant global money market in US dollars held in overseas banks or holding companies, and therefore unregulated by the US Federal Reserve. Called “Eurodollars,” because they originally were dollar savings accumulated in European banks, especially banks in London, these funds quickly became a de facto global currency. LIBOR began as a way for the banks to standardize investment products for these vast pools of American dollars flowing through Europe, and later Japan, the Middle East, and Latin America. By the 1990s LIBOR had become such an important set of interest rates, and US dollars held overseas had becomes such an important source of credit for US consumers, that LIBOR became the key global interest rate around which many financial products were pegged. As LIBOR became more and more important to the globalization of finance, it accrued a sort of official, trusty gloss; nearly everyone assumed that LIBOR was a market rate reflecting competition. Instead, LIBOR has probably all along been a fudged rate, determined less by vast market forces and invisible hands, and more by the vulgar self-interest and power of the elite banks that set LIBOR rates.

Last year government investigations into this globe-spanning crime —rightly called the biggest financial scam in all of history— led to multi-billion dollar fines against Barclays, the Royal Bank of Scotland, and UBS, the 7th, 8th, and 20th largest banks in the world, respectively. Criminal investigations spearheaded by US, UK, Japanese, Canadian, Swiss, and Singaporean authorities are ongoing and aimed at other banks such as Citigroup, JP Morgan, Bank of America, and other “too big to fail” institutions. More details of the crime will be forthcoming as e-mails, internal documents, phone tapes, text messages, and other evidence, is made public, and as the banks are forced to pay significant fines, and sign plea agreements.

Last year government investigations into this globe-spanning crime —rightly called the biggest financial scam in all of history— led to multi-billion dollar fines against Barclays, the Royal Bank of Scotland, and UBS, the 7th, 8th, and 20th largest banks in the world, respectively. Criminal investigations spearheaded by US, UK, Japanese, Canadian, Swiss, and Singaporean authorities are ongoing and aimed at other banks such as Citigroup, JP Morgan, Bank of America, and other “too big to fail” institutions. More details of the crime will be forthcoming as e-mails, internal documents, phone tapes, text messages, and other evidence, is made public, and as the banks are forced to pay significant fines, and sign plea agreements.

While this scandal might seem worlds away, concerning complex financial concepts and obscure money market instruments dealt by bankers out of skyscraper offices in the City of London, the importance of uncovering the complete truth about the LIBOR rigging conspiracy cannot be overstated for local communities across the United States, especially here in California.

Why? First, LIBOR has been used since the 1990s to determine cash flows on interest rate swaps that local governments have purchased from banks to insure themselves against wild swings in variable interest rates owed on billions of municipal debt. Messing with LIBOR messes with the payments due on these instruments.

Why? First, LIBOR has been used since the 1990s to determine cash flows on interest rate swaps that local governments have purchased from banks to insure themselves against wild swings in variable interest rates owed on billions of municipal debt. Messing with LIBOR messes with the payments due on these instruments.

Second, LIBOR has also been used as a main interest rate of reference for an array of investment products that yield a variable return, dipping and rising in concert with LIBOR. Local and state governments have used these investment products, called “municipal derivatives reinvestment products” to temporarily park public funds, while pension systems and government enterprises like utilities use them make investments. Governments and public agencies earn LIBOR rate returns on their dollars invested in numerous kinds of municipal derivatives, so if LIBOR is illegally fixed downward, they earn less income.

Through both of these forms of exposure, local governments have potentially been harmed by LIBOR-fixing perpetrated by the banks, often times the very same banks that have sold them swaps or municipal derivatives investment products.

Through both of these forms of exposure, local governments have potentially been harmed by LIBOR-fixing perpetrated by the banks, often times the very same banks that have sold them swaps or municipal derivatives investment products.

California is fast emerging as a center of investigation and litigation into the LIBOR-fixing conspiracy. California is the largest single municipal debt market in the United States, and one of the largest in the world. Last year alone the state of California and its cities, counties, school districts, and other public entities issued $65.7 billion in total public debt. Because of California’s regressive tax structure and chronic budget crises, the state’s multitude of governments have been among the most aggressive in issuing variable rate debt hedged with interest rate swaps.

The Golden State’s local governments have also been the largest purchasers of municipal derivatives contracts from banks because streams of tax and fee revenues often don’t match up with the dates that payments to public employees and contractors come due. Collusive suppression of LIBOR rates by the 16-member panel who were trusted to provide accurate quotes could mean that California local governments have paid untold millions to their interest rate swap counterparties (the banks) that should otherwise have remained in budgets and used to fund school construction, bus lines, street paving, water and sewerage services, etc.

In the 1990s and 2000s local governments across California increasingly issued bonds with variable rates. Investment bank underwriters and municipal debt advisers from the private sector encouraged variable rate bond financing because it promised lower interest rates for California’s cash-strapped municipalities. To hedge against the risk that variable rates might explode, as they did in the 1980s, the banks sold interest rate swaps to local governments. The swaps effectively converted floating rate debt into a fixed rate. Under a typical swap contract the bank seller agrees to pay a floating rate designed to mimic the variable rate interest on the bond debt, and in return the local government agrees to pay a fixed rate. I’ve written elsewhere about how this deal blew up and created a financial injustice when variable interest rates plummeted during and after the Financial Crisis, but the LIBOR rigging conspiracy adds to these harms. The US government bailed out the banks and assisted them in taking “toxic” derivatives assets off their hands, but stood idly by while cities, counties, and public agencies suffered without aid during the Financial Crisis, allowing derivatives instruments on the public’s books to blow up and drain budgets. At this very moment the banks perpetrated an illegal scam to suck even more money from the public via further depression of LIBOR.

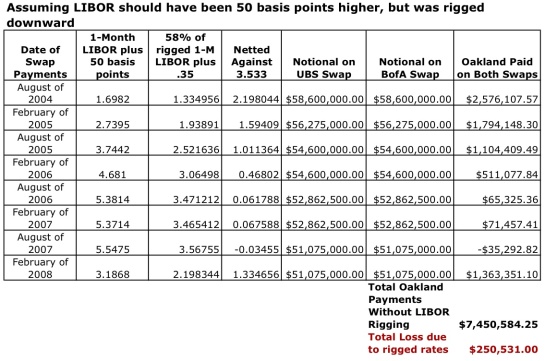

Barclays, RBS, UBS, and other banks worked together to suppress LIBOR below even the depths to which it sank after 2008. A number of lawsuits filed by various cities, counties, and public agencies in California asserts the banks did this to skim off an unknown, but very large, amount of money from their public victims, and also to bolster their own balance sheets during the crisis. By suppressing LIBOR the banks ensured that the net difference between the variable rates they owed, and the fixed rates the public was paying on swaps, was wider than it would otherwise have been. This net difference meant that the public owed the banks higher amounts when the interest rate swap payments came due (usually twice a year).

For San Francisco this could mean that millions have been stolen from the capital budget of its Airport. SFO currently has seven interest rate swaps it has purchased to convert variable rate bond debt into synthetic fixed rates. The airport’s counterparties on its swaps included JP Morgan Chase, Merrill Lynch (owned by Bank of America), and Goldman Sachs. Each of these banks likely benefited from conspiratorial suppression of LIBOR, even if it was by just a few basis points (hundredths of a percent). JP Morgan Chase and Merrill’s parent Bank of America are both members of the panel that sets LIBOR, and are both believed to have played a role in the conspiracy.

San Francisco’s pension system may have also been raided by the banks through its speculative investments in swaps. According to the most recent audit of the San Francisco Retirement System’s portfolio, the city’s pension system holds two interest rate swaps on its books with a notional value of $15 million. In prior years, SFERs held other swaps. In 2010, the Retirement System’s audit showed three interest rate swaps with a total notional value of $41 million. Over the last two years these swaps drained $5.3 million from the pension system, and some of these losses might have been due to the downward manipulation of LIBOR. Also on the Retirement System’s books are other investments in bank loans, options, and other securities that might have been impacted by the LIBOR fraud.

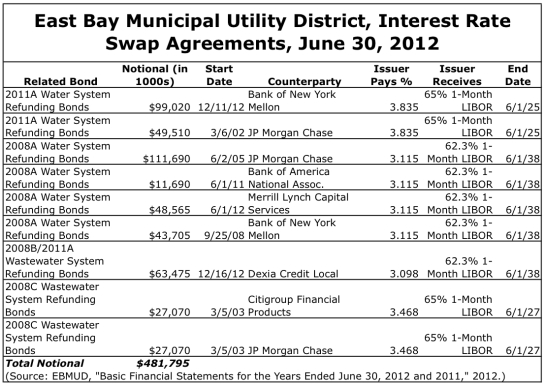

San Francisco’s LIBOR damages are probably small in comparison to other local governments and public agencies. The East Bay Municipal Utility District has already filed a lawsuit in federal court alleging damages from bank rigging of LIBOR. The water district’s complaint, filed in January of 2013, alleges that LIBOR suppression drained potentially millions, again from interest rate swap agreements with some of the very banks that sit on the LIBOR-panel: Citibank, JP Morgan Chase, and Bank of America. East Bay MUD lists nine interest rate swaps potentially affected by LIBOR rigging in its lawsuit.

East Bay MUD’s swaps had a total notional amount of $481 million in 2012, according to the utility’s most recent financial report. Downward manipulation of LIBOR by just 10 to 50 basis points (1/10th to 1/2 of a percent) could have drained between $481,000 to $2,400,000 through East Bay MUD’s swap payments every six months. Over a few years, say the conspiracy’s 2007-2010 time-frame alleged in EBMUD’s lawsuit, this would add up to millions of dollars stolen by the banks.

The cities of Richmond, San Diego, and Riverside, and the County of San Mateo, are other California governments that have now filed lawsuits against the banks responsible for setting LIBOR. All of these lawsuits have been consolidated into a larger class action case currently being heard in the U.S. District Court, Southern District of New York, before Judge Naomi Buchwald. There are now about two dozen LIBOR manipulation lawsuits that have been filed and consolidated in New York. The lead case is the City of Baltimore and the New Britain Firefighters’ and Police Benefit Fund lawsuit against the 16-bank LIBOR panel, filed in April of 2012.

More California cities, counties, and public agencies are expected to file their own lawsuits soon, however. CalPERS, which has numerous investments that fluctuate in value and yield with LIBOR, is also said to be investigating its own exposure to rate rigging.