Capital of Inequality

Part of San Francisco’s Union Square hyper-lux retail offerings, the De Beers store which features armed guards at the entrances. Ferrari recently opened a store a block away on Stockton Street. Haute Couture names obscure fill the district’s buildings offering items of conspicuous consumption.

Through the Financial Crisis and the Great Recession, inequality has intensified through income, housing, and public debt in the Bay Area. Black and Latino communities have lost wealth and power, while white and Asian communities have mostly to recovered. At the top, the wealthiest 5 to 10 percent, have made enormous gains.

Imagine a place where the hills are lined with the mansions of millionaire families, some of them billionaires. Their residences sit atop forested ridge lines with views of a peaceful ocean, or upon oak-studded peninsulas that jut into an azure bay. In this place they want for nothing. De Beers opened a retail store in one of their favorite shopping districts a few years ago, next to haute couture names like Bulgari, Cartier, and Gucci. An investment bank opened a “coffee shop” just a couple blocks from the headquarters of no less than seven Fortune 500 corporations, to catch their employees after work for talks over lattes about what to do with all that money crowding their bank accounts. Posh towers filled with luxury apartments sprout from the city center where multiple cranes seem to perpetually dot the skyline. iPhones pop from the palms of pedestrians like third hands, and newfangled apps like third eyes give them instantaneous information about the latest opulent consumer activities. Everything glows with money and power, a lot of it.

Below the hillsides glittering with wealth are even more expansive terrains of crumbling homes and apartment buildings —many foreclosed upon and awaiting some kind of financial death— packed with families that barely scrape together twenty thousand dollars a year to live on. Their views: smokestacks, port cranes, freeway overpasses, and scrap yards, or, sometimes on a clear day, if they ever think to pause from survival mode, they can see the hills, the mansions, the gleaming skyscrapers beyond reach, the towering campaniles of universities where they can never afford to send their children.

This place is characterized by the crowding of impoverished human beings, most of them of African and Latin American descent, into hollowed out industrial zones where factory buildings and abandoned warehouses echo the bustle of past decades. This economy of yesterday was exported to the new shop floors of China. Among the only things left are the toxic plumes of chemicals spreading slowly under fence lines. In this place entire generations face severe poverty and a decimated public sector – especially the schools. Tens of thousands of adults exist, persist, somehow without meaningful work or income. Tens of thousands of house-less persons —likely no longer even part of the statistical surveys used to calculate joblessness and income— wander the streets and sleep in the cracks of weathered concrete each night. Every few months the police slay a youngster under questionable circumstances. Crime is rampant. Violent crime is hard to avoid, part of the overall suffering.

The splendid heights and stratospheric wealth would not be so contemptible was it not hanging directly over such desperate poverty. Of course the two things are not unrelated.

Welcome to the San Francisco Bay Area, in the Golden State of California.

The West Coast financial center of the United States.

The epicenter of the tech industry.

The global vortex of venture capital.

One of the most brutally unequal places in America, indeed the world.

If measured by the same metrics that are used to gauge income inequality within nation states, the Bay Area’s internal divide between its rich and its poor would place San Francisco between China and the Dominican Republic, making it roughly the 30th most unequal state in the world. China is now the estimated home to 317 billionaires. California counts perhaps 90 billionaires. Half of these, mostly white men, live in San Francisco and Silicon Valley. The Census counted 4.2 million persons slipping below their definition of poverty last year in California.

In the distribution of income and wealth, California more resembles the neocolonial territories of rapacious resource extraction and maquiladora capitalism than it does Western Europe. Oakland is more El Salvador than it is EU. The Bay Area metropolis is more Bangladesh than Belgium.

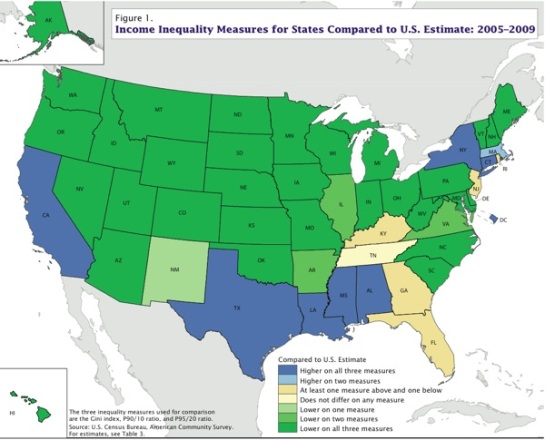

California is just one of seven states that has the distinction of ranking higher than the national average on three basic metrics of income inequality, as measured by the Bureau of the Census. Its gini coefficient of income inequality was most recently measured at 0.47.

The ratio of income between the top 10 percent and the bottom ten percent, as well as the ratio of income between the top five percent and the bottom twenty percent show staggering divides in economic power that few other places in America, indeed the world, surpass.

Source: Weinberg, Daniel H., “U.S. Neighborhood Income Inequality in the 2005-2009 Period,” American Community Survey Reports, U.S. Census Bureau, October, 2011.

The only states that compare to California’s harsh inequalities are deep southern states structured by centuries of racist fortune building by pseudo-aristocratic ruling classes, and the East Coast capitals of the financial sector.

Source: Weinberg, Daniel H., “U.S. Neighborhood Income Inequality in the 2005-2009 Period,” American Community Survey Reports, U.S. Census Bureau, October, 2011.

The economies of Louisiana, Mississippi, and Alabama remain bound by racial inequalities founded in slavery and plantation agriculture; the wealthy elite of all three states remain a handful of white families who control the largest holdings of fertile land, and own the extractive mineral and timber industries, and the regional banks.

Texas, with its sprawling cities, global banks, energy corporations, universities, and tech companies, is more like California in that its extreme economic inequalities are as new as they are old. Stolen land and racial segregation combine with unworldly new fortunes built on the Internet and logistical revolutions in manufacturing and markets to manifest a gaping divide in power and wealth between the few and the many. The Texas border, like California’s, opens up vast pools of Mexican and immigrant labor for super-exploitation by agribusiness and industry.

The same goes for New York, Connecticut, and Washington D.C. the other most unequal places in the United States. New York and Connecticut, like California, have become societies divided by an upper stratum of financial-sector workers and corporate employees whose salaries and investments simply dwarf the bottom half of the population’s earnings, and unlike the South, this extreme level of inequality is rather new in its source of valorization. Washington D.C. is split between the federal haves, mostly fattened contractors who run the military, or who represent the interests of the billionaires in California and New York, and the have-nots, mostly Black and immigrant service sector workers who wait on these technocrats of empire.

It’s a strange club, the super-inequitable states of the U.S. This exclusive list pairs the bluest coastal enclaves of liberal power with the reddest Southern conservative states. In terms of wages and wealth these places have a lot in common.

San Francisco’s real estate roller coaster. The Financial Crisis cut 20% off home values in San Francisco, but the U.S. Federal Reserve’s bond buying program, coupled with broader tax and fiscal policies, has created a rally in securities markets, handing the wealthiest Americans enormous gains in net worth. These economic policies benefiting the rich are evident in San Francisco’s real estate prices. Secondarily is the Tech 2.0 boom in San Francisco and Silicon Valley, pulling in thousands of new residents to work in Internet, biotech, and other industries where six figure salaries are the norm.

In San Francisco homes now routinely sell for millions. Not mansions. Not even particularly large houses. Just simple homes built decades ago. In most other markets they would fetch the national median home price of about $170,000. San Francisco, which locals like to call “the City,” sees dozens of real estate deals every month in which a cool million or two pass hands, and afterward the new owner, usually someone with freshly minted tech or finance money, has the modest structure demolished and scraped away. The new thing is to build upward, and lavishly, from scratch. Heated stone bathroom floors and wine cellars are popular. Securing a pad in Noe Valley or Bernal Heights for a few million is seen as a reasonable way to spend money.

In San Francisco the western end of Broadway is known as “billionaire’s row.” Quite a few of the side streets and parallel avenues like Jackson, Pacific, and Washington are lined with estates that trade hands on occasion for a few tens of millions. No tear downs here. The villas and manors along these avenues were built by sugar barons and banking tycoons of centuries past. Silicon Valley’s most senior executives, and the City’s hedge fund managers, buyout barons, bankers, and a few celebrities make up most of the neighborhood’s owners. Their children attend exclusive private schools in Pacific Heights where they are preened for Stanford and Princeton.

It is becoming hard to identify any part of San Francisco as an “elite” enclave. Tech 2.0, as the Google and Facebook-led regional boom is being called now, has vested thousands of twenty somethings as well as senior executives with billions in IPO cash and billions more in salaries to hunt for real estate, and they have chosen San Francisco, nearly all of it, as their preferred stomping grounds. Maybe it will only be another decade until Broadway starts getting called trillionaire’s row.

Sea View Avenue, Piedmont, California. 71 percent white, only 5 percent of Piedmont’s population is Black or Latino. Median household income is $200,000, and wealth holdings are much more. Piedmont supports its own public schools, police force, parks, and libraries.

Across the Bay is a slightly more modest version of billionaire’s row, probably better called a millionaire’s row running across the ridge line from Oakland north to Kensington. In the middle of Oakland, in fact completely surrounded by the scrappy industrial city by the Bay, is the city of Piedmont. When it was founded in the 1920s its first residents gave it the nickname “city of millionaires.” They restricted housing to single family residential homes on large lots from the start to prevent Black and immigrant families from moving up the hillside. Sea View Avenue is where the big money that wants to show off buys real estate, but the entire city boast a median home price of $1.4 million. The Berkeley hills are similarly rich and populated by an unusually high number of lawyers.

Lawyers, especially tort defense, corporate, and tax lawyers who serve the wealthy and defend corporate America from labor unions, environmentalist, and consumer advocates, also love Marin County. Across the Golden Gate from San Francisco, Marin is not much more than a bedroom community for corporate lawyers and CEOs who want a little more room and sun than San Francisco provides. If Piedmont was a city shelter to exclude the working class, then Marin is similar, but on the level of a county. Despite growing pockets of Latino poverty in older towns like Novato and San Rafael, Marin remains one of the wealthiest counties in the U.S. on a per capita basis. Marin’s Black population is segregated into the tiny Marin City, one of the only places public housing was allowed to be built. Marin City’s residents work in the retail sector and some of the industry along San Rafael’s waterfront. They earn near the bottom of the region’s wage scale and subsist on a fraction of the income their wealthy neighbors take in each month.

Hagenberger Road, East Oakland. Oakland is over 50 percent Black and Latino. Sections of the city such as the area pictured above are 90 percent non-white. In the typical pattern of environmental racism, residential homes are in close proximity to major roadways, highways, rail lines, industrial facilities, scrap yards, and utilities.

Unemployment stalks the working poor of the Bay Area, threatening to force them into insolvency and bankruptcy, foreclosure and displacement. During the first Dot Com boom of the late 1990s unemployment was at five percent for white Bay Area residents. For those living along the billionaire’s and millionaire’s rows, unemployment is a meaningless concept. The capital invested by the rich, by their clever advisers who run the hedge funds and private equity shops, earns interests and returns on equity far larger than any years honest wage labor can eek out. The tax code provides for this with carried interest and the lowest personal income tax rates for top earners in many decades. Hordes of tax lawyers, many who live in Marin, the Oakland hills, and San Francisco, will eagerly structure a family’s investments and bills to minimize taxes, so long as they possess a minimum of $5 million in liquid assets – preferably more.

Black men in the Bay Area have consistently suffered an unemployment rate double that of white men. Through the entire George W. Bush presidency, a period characterized by an economic policy to benefit the wealthiest with low taxes and interest rates, Black men endured double digit unemployment rates, reaching about 13 percent when Obama took office. The Financial Crisis sent Black unemployment rates skyrocketing in San Francisco, Oakland, Richmond, and Vallejo, upwards of 22 percent in 2010.

Economic policies under Obama —both those he championed, and those he compromised on— have been very good for the wealthy, and that’s reflected best by the real estate and consumption bubbles frothing over places like San Francisco. The Federal Reserve Bank’s unprecedented purchases of bonds and its low lending rates have produced rallies in stock and debt markets which have greatly re-inflated the fortunes of the rich.

Economic policies under Obama —both those he championed, and those he compromised on— have been very good for the wealthy, and that’s reflected best by the real estate and consumption bubbles frothing over places like San Francisco. The Federal Reserve Bank’s unprecedented purchases of bonds and its low lending rates have produced rallies in stock and debt markets which have greatly re-inflated the fortunes of the rich.

The Pew Research Center recently summed up this polarizing redistribution of wealth from the bottom to the top by noting simply that since 2009 the wealthiest 7 percent of Americans experienced an increase of 28% in their net worth, while the bottom 93 percent actually lost 4 percent of their savings.

The Pew Research Center recently summed up this polarizing redistribution of wealth from the bottom to the top by noting simply that since 2009 the wealthiest 7 percent of Americans experienced an increase of 28% in their net worth, while the bottom 93 percent actually lost 4 percent of their savings.

The San Francisco Bay Area’s current tech boom is further dividing the wealthy few from the impoverished masses. Companies like Google, Apple, and Oracle are among the least diverse workplaces places where men outnumber women, and white and Asian employees dominate the ranks of lowly programmers and senior executives. The need to hire thousands of engineers is drawing waves of college graduates to Silicon Valley and San Francisco, and they’re washing over the current residents like a tide of suffocating oil. Some of the tech buses —private transit systems operated by Silicon Valley’s largest firms to shuttle employees from San Francisco to their suburban campuses in Santa Clara County— now run lines into Oakland and Hayward, a sign that their employees are increasingly colonizing formerly undesirable zones of real estate.

The drift apart between the pale wealthy few and the impoverished multitudes of darker-skinned peoples is evident on the level of whole cities. San Francisco enjoys robust public finances, high credit ratings, low per capita debt to income ratios, and many well funded public services. However, two decades of intense gentrification mean that this healthy public sector increasingly caters only to those “citizens” who can afford to live in San Francisco.

Pushed out of the region’s urban core, in the 1990s and 2000s Black, Latino, and some Asian immigrants found themselves in the affordable locales of Vallejo, Stockton, Richmond and Oakland. Further out towns like Antioch, Brentwood, and Pittsburg became increasingly non-white and working class. In the Financial Crisis these cities hemorrhaged residents and revenues due to some of the highest foreclosure rates in the nation. Vallejo and Stockton went bankrupt after slashing the most basic services. Vallejo is 75 percent non-white. Stockton is 80 percent non-white.

The wealthiest Bay Area communities, the “towns” of Hillsborough, Woodside, Atherton, Los Altos Hills, and the city of Piedmont are three quarters white with median incomes in the six figures. Public finances barely flinched during the Great Recession. A few of these local governments in fact have no outstanding public debt.

Atherton and Los Altos Hills have zero bonded public debt.

Oakland has almost a billion just in bonded debt.

In the tony Marin hamlet of Fairfax the public debt burden resting on each resident is about 1.7 percent of their annual income.

In Richmond the ratio of public debt to personal income for each resident is 16 percent.

Richmond, a quarter Black and a third Latino, is a tangle of oil and chemical refineries run primarily by Chevron. Not a year ago a massive fire at one of the company’s plants spewed toxic vapors and smoke into the sky, poisoning thousands of residents.

Chevron is headquartered in San Ramon, another exclusive, mostly white suburban environment with low municipal debt and a household median income of $121,000 a year.

In your caption for the Sea View photo, you mention that Piedmont supports its own public libraries, but it does not. Residents of Piedmont rely on the Oakland Public Library system. Piedmont contributes to these libraries but does have a system of its own. In 2011, when facing deep budget cuts stemming from the financial crisis, the City of Oakland asked Piedmont to increase its contribution (Oakland citizens were paying roughly $50/yr for library services, Piedmonters only around $35/yr), but Piedmont declined, noting that all California residents were eligible for library services and that they were not required to contribute any money at all. A minor point, but symbolic nonetheless of the ways the wealthy manage to appropriate public resources without contributing much to the community.

Thanks for the correction William. You’re making an important point about Piedmont’s reliance on Oakland’s infrastructure and services, in effect a large subsidy.

“The Federal Reserve Bank’s unprecedented purchases of bonds and its low lending rates have produced rallies in stock and debt markets which have greatly re-inflated the fortunes of the rich.”

Is this really a statement of fact? Stick with statistics and measurements when making your argument. Statements like this only erode your credibility.

There is no doubt that the Fed’s quantitative easing program has buoyed the prices of equities and bonds. Because the wealthiest 1-5% hold the majority of stock and bond wealth, this has greatly inflated their net worth. The Pew study I linked in this piece makes this very point. Do you consider Pew and its economists “credible”?

Here’s just a few recent media pieces making this same point:

http://www.forbes.com/sites/investor/2013/01/30/how-the-fed-is-helping-to-rig-the-stock-market/

http://www.businessweek.com/articles/2013-02-06/home-prices-stock-rallies-and-the-wealth-of-a-nation

http://money.cnn.com/2012/09/20/news/economy/federal-reserve-rich/index.html

Home prices are catching up now, which should produce a more modest rise in net worth for about 60 percent of Americans, but the gains seen by the upper 95th or 90th percentiles are much larger than anything the middle classes will see as housing prices lift.

Whether any of this is sustainable, I have not idea.

You still haven’t convinced me that this is a fact. How do we know that increased corporate profits and productivity aren’t the real source of rising asset prices? The short answer is we don’t. It’s impossible to disentangle the cause from the effect, to understand the direction of causality. In economics, no variables are independent.

If instead, you had stated that the rich have recovered from the financial crisis as asset markets have rebounded, there would be no argument. There is no issue with your larger argument. The only issue is the statement about the Fed inflating the wealth of the rich. It does nothing to serve the larger argument.

It remains to be seen whether housing prices will sustain after QE is dialed back. Much of existing QE has gone into reinflating housing prices by socking away bogus MBS and allowing banks to hold homes off of the market.

Developers own local politics in the Bay Area. Real Estate is the only part of the FIRE economy that must occur in situ. The full force of Wall Street’s rent seeking political apparatus comes to bear on local discretionary land use and entitlement processes.

We just sold our home in Walnut Creek! It is amazing how the East Bay is changing so rapidly as well. Thanks for this awesome blog. Have you done an report on this on Walnut Creek as well and Broadway Plaza?

economics is money changing

hands

yet

the hand taking

always has more control than

the hand

giving

thanks

What do you think the US (or California) government should do to fix these inequalities? Adopt more *gasp* socialist policies like in Norway and the rest of Scandinavia (which have very low Gini index values http://en.wikipedia.org/wiki/List_of_countries_by_income_equality)?

I don’t think any of the countries in Scandinavia or the rest of Europe would call themselves Socialist. This is not the USSR. Greetings from Europe where we have a free market economy, but everyone can afford to go to university (except in the UK) or to hospital.

They call it social democracy: http://en.wikipedia.org/wiki/Nordic_model

And I’m European too, by the way.

Inequality (of outcomes) is always the price you pay for freedom. Capitolism is the worst economic model known to mankind EXCEPT for all the others! Ronald Reagan’s policies and the resulting quarter-centery of prosperity made the rich richer, but the poor even richer and (traditional) American capitolism and freedom made the poor here the envy of people all over the world. Unfortunately the Obamanation has persued the exact opposite policies of Ronald Reagan and conservatives by growing government, taxes, and stifiling regulations, and, as expected, we are now reaping the opposite results as expected.

Inequality does not need to be the price for freedom. In fact inequality destroys some parts of freedom: http://andreasmoser.wordpress.com/2012/05/21/equality-versus-sufficiency/ Those who are very poor will be forced to work for those who are rich. Those who are poor will be crowded out of the housing market, of the health market, of the education market.

Let’s become communist, then. Maybe then your freedom will be taken away, and maybe we don’t have to pay the price of inequality. Instead, we can live our lives in conformity with no individualism so everyone can have the same exact “opportunity” to live their dream lives. Do you not understand that capitalism is the natural system of the world. We see it among animals, among plants, among the natural environment. The truth is painful, and the nature of life is to work and to survive until you make it where you WANT to be (and this is different for every person; for some, its about the almighty dollar). Socialism is not the better solution; it (like communism, except a little more capitalist) would actually give the rich more power! To have socialism, you need a central authority (a government) to oversee the distribution of money. Who’s going to be that authority? Well, the rich, the powerful, the wealthy. Plus, if we want socialism to work, we need everyone working. We can’t just have people doing some work or no meaningful work then expect someone else to put bread on the table. That system will fail entirely on a national stage. So if you want a system where people can have the freedom to control their own lives, capitalism is that system. The problem is that we have forgotten what capitalism is, and we have tried to change it so we can help EVERYONE. How can we possibly help everyone? Capitalism is a system of opportunities, of social mobility, and of national prosperity. Not everyone will make it to survive, and not everyone will fall. Some people will have greater opportunities than others. Some people will be able to offer more than others. What you said about Reaganomics and Obamanation are pretty much true, but you need to understand the facts behind them, not just the statistics. With Reaganomics, its policies tried to stimulate the economy (meaning that businesses, I am talking small businesses, could grow and new businesses could open up and people could find jobs) by lowering interest rates, beating down inflation, and cutting taxes to allow more spending for economic growth. You can’t say that small businesses couldn’t grow under those conditions, and you can’t say that people couldn’t find new hirings. That’s the good part about Reaganomics. Now the rich (who are PART OF THIS SYSTEM AS WELL) had the same opportunity to make use of lower interest rates, lower inflation, and lower taxes. They could borrow more and have more buying power and keep more of their salaries and profits. So while the world of small businesses grew, the rich grow much richer because they had SAME benefits but also had more credibility, more capital, and more connections to be able to borrow way more and to find good investments for great returns. With Obamanomics, government has grown along with its spending on social programs. Taxes have gone up and regulations have become stricter. And the result, the poorer are richer! Yeah, but so are the richer. The poorer are richer because they are given money from the government. The government just gives them money like that, if you quality, and the poor do qualify. So the poor look richer, but they only look rich because money has come from the richer to hide the truth that the poor are still poor. The money just adds to statistics, but nothing has changed. In fact, the unemployment rate is only a statistic covering up the truth. People have stopped looking for work, so when unemployed people have stopped looking for work, they are no longer included in the unemployment rate. What has happened is, the rich have actually become richer. They actually made real money that they earned through investments, profits, salary, etc. But let me tell you that the richer people made some of their money from the government. The government just gave them money, so the statistics for the rich is kinda hiding the truth too. Wait, let me tell you the government did not just hand the rich some money and walk away. The government pumped money into the economy (we all know this as QE) to stimulate it; the money just went into the stock market, where rich people make a lot of money fast and not-that-rich people make only some money because they don’t have enough to invest to make a huge return with. Anyway, I need to end here because I’m writing too much. I would like to hear what you think so just reply if you want.

Reblogged this on American Patriots Unite.

“Pushed out of the region’s urban core, in the 1990s and 2000s Black, Latino, and some Asian immigrants found themselves in the affordable locales of Vallejo, Stockton, Richmond and Oakland. Further out towns like Antioch, Brentwood, and Pittsburg became increasingly non-white and working class.” I feel like this is more of an issue of discrimination, which stemmed from decades and decades prior to now. Any minority group has a higher risk of unemployment than the average white male. Unemployment would then result in poverty, which could potentially lead to foreclosure. There are obviously a multitude of factors, but right now I am only listing one. My point is, I guess, that the “wealthy” aren’t the ones to blame. The government is truly at fault, which no doubt consists mainly of old, rich, white men, but we’re supposed to “trust” that they have our best interests in mind.

This makes me want to look into Seattle-Bellevue-Redmond-Kirkland et al areas. It would not surprise me to find a very similar situation here as well.

Interesting and quite thorough I would not be surprised if we saw a similar effect continue and spread. Although It is becoming more about money in your pocket and less about the color of your skin. Soon it will just be back to the Super rich and the Super poor. Well if things continue trending the way they are that is.

New York City, as intimated in New York state’s high Gini coefficient, is under going the same process — just substitute Manhattan for San Francisco. Much of Brooklyn is under extreme pressure of gentrification, parts of Queens and the real estate industry is trying to rebrand the South Bronx as “SoBro” or “Downtown Bronx.” Yes, that matters, because New York City is a dictatorship of Wall Street and the real estate industry. The mayor is a multi-billionaire who made his fortune on Wall Street and governs accordingly.

Gentrification is not something that just happens. It is the replacement of a people, particularly the poor members of a people, with others of a lighter skin complexion. A corporatized, sanitized and usurped version of the culture of the replaced people is left behind as a draw for the “adventurous” who move in and as a product to be exploited by chain-store mangers who wish to cater to the newcomers. The Lower East Side, for instance, used to be a counter-cultural haven, a center of organized resistance and a low-rent neighborhood for those who needed that; now it is nothing but a playground for rich kids who have no concept of what the neighborhood once was plundered by landlords who extract skyrocketing rents.

The staggering inequality the neoliberal onslaught has brought us is unsustainable. As the saying goes, when the environment is destroyed, the air is polluted and the water is drained, you won’t be able to eat money.

I want to abolish the Federal Reserve! Who’s with me?

If you don’t like the Federal Reserve, your problem is actually the capitalist system. Central banks like the Fed are necessary for capitalism to function, which is why every country has one. The booms and busts would actually be worse (and were before the Fed was established) and the banks would have even more control (as they did – big banks actually printed money rather than the Treasury Department in the 19th century).

Fixating on basic instruments of the system instead of the system itself unfortunately tends to becomes an exercise in avoiding an examination of structural root problems, however unintentional that may be on any individual’s part.

The Federal Reserve was established while the US dollar was still gold based. It is a policy decision for congress to delegate its monetary authority to a private bank. This policy decision can be reversed. There are reasons why currency blocs with private central banks are all suffering fiscal and monetary crisis now, because of a lack of public credit for the public benefit has created a space for economy wide extortion from those favorably situated running the central banks. Power and authority without accountability are illegitimate.

Inequality seems to plague cities where finance is king. I blog similarly about the plight in Hong Kong. There is an amazing sameness to the stories, though race/ethnicity does not play out so boldly in the HK case–it is still there, but harder to establish as ethnic distinctions are made within racialised groups.

Great article, the same thing is happening to downtown Johannesburg at a rate that seems to be quickly picking up.

Reblogged this on Counting down to a dream's end..

Reblogged this on cwfact and commented:

Its Average

A similar situation prevails in the Silicon Valley area of San Jose. Bill Moyers has an excellent video [http://billmoyers.com/content/homeless-in-high-techs-shadow/] interviewing residents who have become homeless as the former manufacturing jobs were moved overseas. Moyers points out that while Facebook, Google and Apple have made stockholders rich, “not far away, the homeless are building tent cities along a creek in the city of San Jose. Homelessness rose 20 percent in the past two years, food stamp participation is at a 10-year high, and the average income for Hispanics, who make up a quarter of the area’s population, fell to a new low of about $19,000 a year — in a place where the average rent is $2000 a month.”

Silicon Valley employers are seeking the importation of yet another 100K south Asian tech workers to undercut American wages. Because the paucity of women and non-Asian people of color in STEM (Science, Tech, Engineering and Math) is not few enough, nor is the rampant culture of age discrimination.

The only commonality in the immigration bill before congress is that it guarantees employers a ready source of stable, lower income workers to keep profits high with no care towards the best interests of American working people. It is criminal to tie dignity for Latino immigrants to slitting the throats of American tech workers.

It would be interesting to see if the unemployment and wealth gaps that exist between these various enclaves correlate with a difference in scores on the Scholastic Aptitude Test and American College Testing Program examination.

Pingback: The United States’ Capitals Of Inequality | Design Interaction

I enjoyed reading your article. It is very interesting, and your writing abilities are excellent. The way you write paints a perfect picture of what you want your readers to imagine. I must give you credit for that. You expressed the concerns you feel in an effective manner that reaches into a reader’s heart. I am now a loyal subscriber because I like to see what you think, and it’s interesting.

Reblogged this on A Random Encounter.

Reblogged this on Photos of South Africa by Travis Caulfield and commented:

Really interesting article – interesting to think about how this relates to South Africa.